Share This

Reverse Engineer the Process. This is the most effective way to get ANYTHING YOU WANT in life, but ONLY if you're willing to do the work.

Let's be honest here...

How bad do you want to have a high paying career in IT, opportunities for you to grow, more joy, happiness, and fulfillment in your life?

You can spend a whole damn day writing a list of everything you want.

But what about the list of things that need to happen for you to ACTUALLY achieve them?

See,

There are powerful and strategic routines you need to have in place that are designed to get you the end result you want...

KNOW WHAT TO DO AND HOW TO DO IT MATTERS - A LOT!

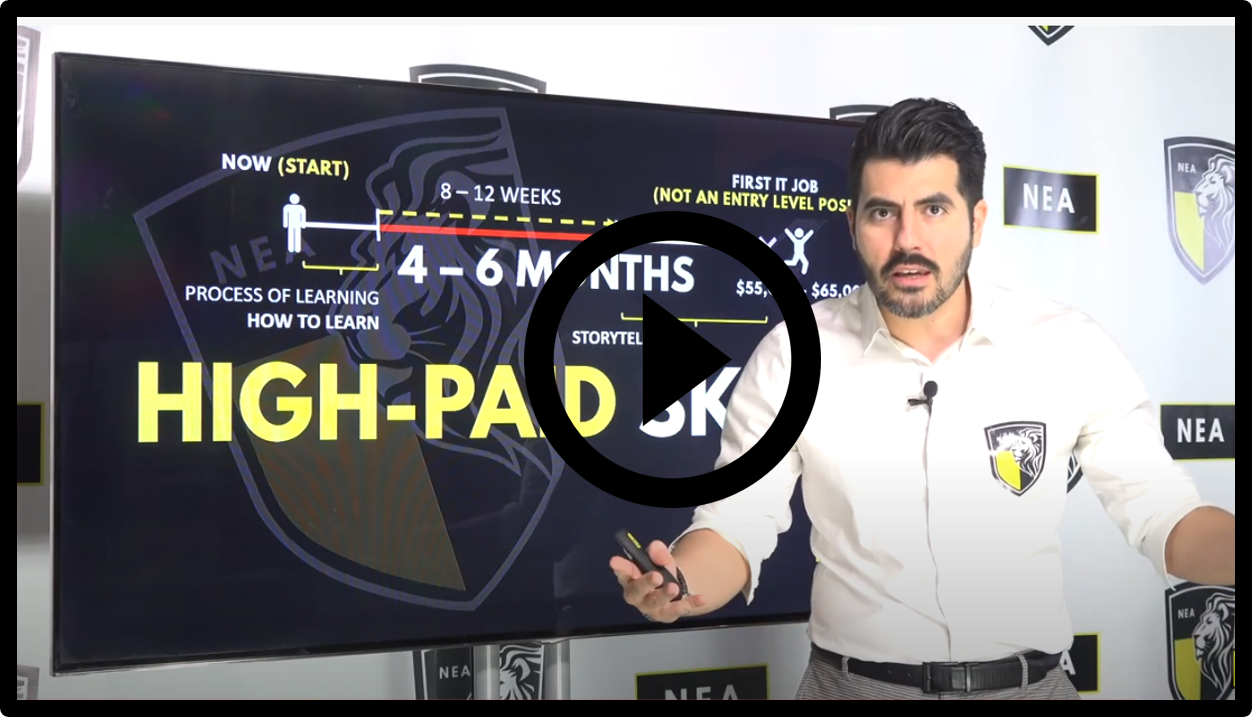

In this video I will show you the strategies and routines.

Also, there are things you need to do about how to approach, who you need to become, what to do, how to do it, and the high-paid skills you need to learn to get all the way to a high paying IT job.

In this video I'll help you have clarity and certainty around those things you have to do and focus on in the next few months, this will allow you to move fast and execute on them.

There’s hard work that needs to get done and targets (goals) that need to be hit...

I'll show you how to reverse engineer your targets and help you amplify your productivity to achieve each one of them in the next few months for you to get the job you want.

I am really excited about sharing the detailed plan with you.

And yes! It works, students have gotten a better higher paying job in their IT Career by following this same process/plan.

The question here is...

ARE YOU WILLING TO PUT IN THE WORK TO GET IT?

What's Taking place i am new to this, I stumbled upon this I have found It positively helpful and it has helped me out loads. I'm hoping to give a contribution & help different users like its helped me. Good job. my site - Maxie

Thanks for sharing this valuable information about car accidents and legal representation in Waco, TX! injury attorney waco

Poured-in-place terrazzo floors offer not only resilience but also endless customization options depending on your vision!!!## anykeyword ## albuquerque tree removal

So glad I stumbled upon this article; I needed some motivation to start my own exterior project! stucco companies albuquerque

If you want stress-free moving, trust me – go with Long distance movers Glendale in Glendale!

Every weekend i used to pay a visit this website, for the reason that i want enjoyment, for the reason that this this site conations in fact good funny data too. my web site basketball legends tricks and tips

Elite Garage Door Repair deserves all the praise! Be sure to visit them at garage door opener repair .

Thanks for the insightful write-up. More like this at loan agency new orleans .

Fascinating read! The idea that proper setup can expand the life of a pole barn garage is something lots of people overlook. I'll consider even more relevant web content at Pole Barn .

Scant clarity as yet on US trade talks * mega сайт ссылка-cap earnings, US jobs and GDP data on tap * Global recession risk high due to Trump's tariffs, economists say * Canadians vote in election dominated by concerns about Trump (Updates to afternoon) By Stephen Culp NEW YORK, April 28 (Reuters) - U.S. stocks turned lower on Monday, while their European counterparts gained, and gold advanced as investors monitored progress in tariff talks at the top of an eventful week of corporate earnings and economic data. Tech sector weakness, particularly in the so-called Magnificent Seven group of artificial intelligence-related megacaps, weighed heavily on the S&P and Nasdaq as the session progressed, while safe-haven gold rebounded. "We had a nice rally last week," said Ross Mayfield, investment strategy analyst at Baird in Louisville, Kentucky. "But in the absence of a major positive catalyst I think it's going to be harder for equities to climb much higher from here." Mayfield called Monday's market gyration "just a little bit of drift, with a lack of catalysts and with a lot concentrated in the back half of the week." U.S. Treasury Secretary Scott Bessent said on Monday many top U.S. trading partners have made "very good" tariff proposals, adding that China's recent moves to exempt certain U.S. goods from its retaliatory tariffs showed a willingness to de-escalate tensions between the world's two largest economies. "We were at a point where, unless we get a major resolution on the trade front, or big upside from some of the economic data or earnings this week, I think we're in this trading range that I feel we're going to be trapped in for a while," Mayfield said. Despite hopes for progress, economists polled by Reuters see a high risk of global recession due to Trump's tariffs. Three months ago, they projected the world economy growing at a healthy clip. First-quarter earnings season heats up this week, with Meta Platforms, Microsoft, Apple and Amazon.com among the high-profile results on the docket. While no U.S. economic data were released on Monday, the week is back-end loaded with closely watched indicators such as Personal Consumption Expenditures, the Institute for Supply Management's purchasing managers' index, an advance take on U.S. GDP and the April employment report. The Dow Jones Industrial Average fell 34.65 points, or 0.09%, to 40,078.85, the S&P 500 dropped 21.61 points, or 0.39%, to 5,503.37 and the Nasdaq Composite slid 115.55 points, or 0.66%, to 17,267.39. European shares rose as investors remained optimistic that U.S.-China trade tensions would wane. MSCI's gauge of stocks across the globe rose 0.58 points, or 0.07%, to 825.29. The pan-European STOXX 600 index rose 0.53%, while Europe's broad FTSEurofirst 300 index rose 10.13 points, or 0.49%. Emerging market stocks rose 6.01 points, or 0.55%, to 1,103.11. MSCI's broadest index of Asia-Pacific shares outside Japan closed higher by 0.59%, to 574.00, while Japan's Nikkei rose 134.25 points, or 0.38%, to 35,839.99. U.S. Treasury yields eased ahead of critical earnings and economic data this week. The benchmark U.S. 10-year note yield fell 4.4 basis points to 4.222%, from 4.266% late on Friday. The 30-year bond yield dropped 4 basis points to 4.6981% from 4.738%. The 2-year note yield, which typically moves in step with interest rate expectations for the Federal Reserve, fell 6.9 basis points to 3.693%, from 3.762% late on Friday. The dollar edged lower against a basket of currencies as investors awaited further trade talks progress and girded themselves for an eventful week. The dollar index, which measures the greenback against a basket of currencies including the yen and the euro, fell 0.69% to 99.05, with the euro up 0.4% at $1.1409. Against the Japanese yen, the dollar weakened 1.03% to 142.19. Sterling strengthened 0.8% to $1.3421. The Mexican peso weakened 0.3% versus the dollar at 19.591. The Canadian dollar strengthened 0.07% versus the greenback to C$1.38 per dollar. Canadians are going to the polls on Monday after an election campaign in which U.S. President Donald Trump's tariffs and musings about annexing Canada became the central issue. Crude oil softened as investors weighed a potential supply increase from OPEC+ amid ongoing trade uncertainties. U.S. crude fell 1.54% to settle at $62.05 per barrel, while Brent settled at $65.86 per barrel, down 1.51% on the day. Gold prices advanced in opposition to the easing greenback as bargain-hunting kicked in. Spot gold rose 0.92% to $3,348.51 an ounce. U.S. gold futures rose 0.06% to $3,284.50 an ounce. (Reporting by Stephen Culp; Additional reporting by Dhara Ranasinghe in London; Wayne Cole in Sydney; Editing by Nick Zieminski and Richard Chang)

I found this very interesting. For more, visit water damage restoration companies .

Excitedly waiting for breakthroughs referring to lightweight components being offered into cylinder manufacturing techniques!!!!# # anyKeyWord ## Have a peek at this website

I'm curious about how long-term use of synthetic fertilizers impacts our soil health in Fogelsville? There’s a good analysis at Lawn aeration and fertilization !

Really having fun with experimenting w/whipped topping mixtures as of late...all thanks too stunning sources attainable thru MR CREAM CHARGERS MELBOURNE!!!" ###ANYKEYWORD## http://www.premio-tuning-bestellshop.at/Home/tabid/2115/Default.aspx?returnurl=https://www.first-bookmarkings.win/make-recollections-unforgettable-accumulating-friends-relations-sharing-scrumptious-bites-exploring-flavors-loved-at-the-same-time

I tried doing it myself but failed miserably—definitely need to call Broadleaf weed control !

Thanks for the great content. More at physical therapy near me .

Appreciate the detailed post. Find more at kitchen remodeling .

Are there ways we could involve schools more actively preventing youth exposure towards harmful substances early on ?# # anyKeyw ord ## residential addiction treatment

The beauty of exposed aggregate concrete surfaces is simply captivating! tree service albuquerque nm

“Addressing co-occurring disorders alongside addiction can lead to better recovery outcomes.” 12 step drug rehab