Share This

Reverse Engineer the Process. This is the most effective way to get ANYTHING YOU WANT in life, but ONLY if you're willing to do the work.

Let's be honest here...

How bad do you want to have a high paying career in IT, opportunities for you to grow, more joy, happiness, and fulfillment in your life?

You can spend a whole damn day writing a list of everything you want.

But what about the list of things that need to happen for you to ACTUALLY achieve them?

See,

There are powerful and strategic routines you need to have in place that are designed to get you the end result you want...

KNOW WHAT TO DO AND HOW TO DO IT MATTERS - A LOT!

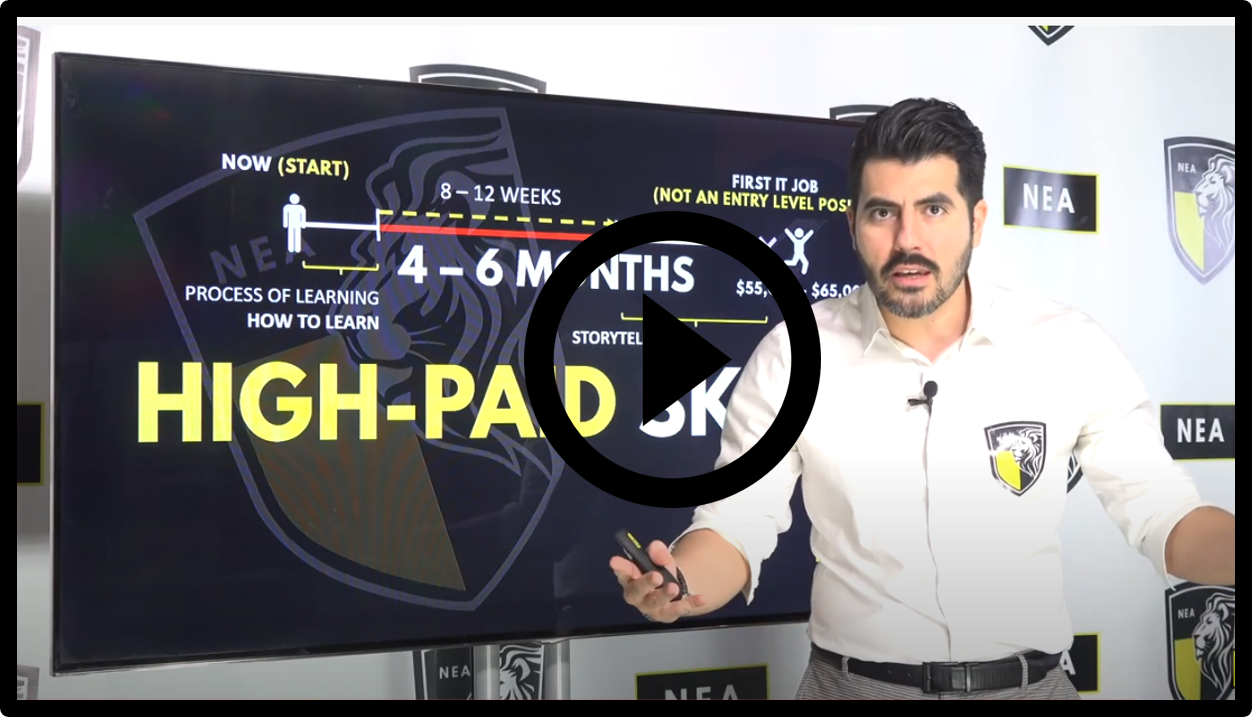

In this video I will show you the strategies and routines.

Also, there are things you need to do about how to approach, who you need to become, what to do, how to do it, and the high-paid skills you need to learn to get all the way to a high paying IT job.

In this video I'll help you have clarity and certainty around those things you have to do and focus on in the next few months, this will allow you to move fast and execute on them.

There’s hard work that needs to get done and targets (goals) that need to be hit...

I'll show you how to reverse engineer your targets and help you amplify your productivity to achieve each one of them in the next few months for you to get the job you want.

I am really excited about sharing the detailed plan with you.

And yes! It works, students have gotten a better higher paying job in their IT Career by following this same process/plan.

The question here is...

ARE YOU WILLING TO PUT IN THE WORK TO GET IT?

I just had my roof replaced, and this article was super helpful in understanding the process! For those considering a replacement, check out Amstill Roofing Roofing Company in Houston for great resources

Today, I went to the beach front with my kids. I found a sea shell and gave it to my 4 year old daughter and said "You can hear the ocean if you put this to your ear." She placed the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is totally off topic but I had to tell someone! my blog ... https://ggbetcassino.com/id/

I have actually been implying to read more concerning different types and their certain grooming dem petco groomer near me

Party At Your Home Children - Make It Easier 하이오피사이트

Choosing An Isolated Perfume Shop 다바오머니상

Poker Cheats For Facebook 에볼루션 카지노 취업

10 Eco-Friendly Save Of Your Las Vegas Vacation 하이오피사이트

12 Hot Places And Ways To Meet 30-Plus Cool Singles (Bars Not Included) 하이오피

Hi mates, how is all, and what you wish for to say about this article, in my view its genuinely amazing in favor of me. My blog; wyłączanie adblue

I can’t recommend Şirvan Sofrası enough for its outstanding kebap and fish dishes! The ambiance is also perfect for enjoying a meal in Sultanahmet. For more details, visit Recommended restaurants

This article discusses the benefits of hiring a roofing contractor who specializes in skylight installation. If you're interested in adding natural light to your home through skylights, I suggest reaching out to roofing company for their expertise

By Lewis Krauskopf NEW YORK, Oct 8 (Reuters) - Investors are looking for bargains among healthcare stocks, even as prospect of a Democratic "Blue Sweep" in next month´s elections threatens more volatility for a sector already trading near a historical discount to the broader market. A victory by former Vice President Joe Biden over President Donald Trump on Nov. 3 and a potential Democratic takeover of the Senate could clear the way for prescription drug price and healthcare coverage reforms, generally seen as potential negatives for companies in the sector. Some investors are betting these factors have already been priced into healthcare shares or may not be as detrimental as feared, while the companies stand to benefit from relatively stable earnings prospects and their medical innovations. "For high-quality companies that are trading at reasonable valuations ... there is a strong argument to be made for adding some healthcare exposure to portfolios," said James Ragan, director of wealth management research at D.A. Davidson. Biden's improving election prospects have weighed on healthcare stocks for much of 2020, according to investors, with the S&P 500 healthcare sector climbing just 7% since the end of April, against a 17% gain for the overall S&P 500 . A Reuters/Ipsos poll on Sunday showed Biden opened his widest lead in a month after Trump contracted COVID-19. The healthcare sector now trades at a 26% discount to the S&P 500 on a price-to-earnings basis, according to Refinitiv Datastream. The sector's 15.8 P/E ratio is well below the S&P 500's 21.3 ratio, which last month rose to its highest valuation since 2000. The gap between the sector's P/E ratio and that of the S&P stood at its widest in at least 25 years last month, though it has narrowed in recent weeks. "As Biden started to do better in the polls, you saw healthcare start to underperform a bit as the rest of the market recovered," said Ashtyn Evans, a healthcare analyst with Edward Jones. While Biden may shake up insurance coverage by offering a "public option" government plan, he is also expected to seek to strengthen the Affordable Care Act - the signature healthcare law enacted when he was vice president - under which companies are used to operating. Any significant drug pricing legislation may need to wait until the pandemic is more contained, as the government relies on the pharmaceutical industry to develop COVID-19 therapies and vaccines. Trump has also vowed to lower drug prices, making the issue arguably less partisan. "We think there remains a reasonably good probability that the next Congress will institute moderate health policy changes that will create long-term clarity for the sector and investors," Eric Potoker, an analyst at UBS Global Wealth Management, said in a note last month. Healthcare stocks have been prone to volatility around elections. Ahead of the 2016 vote, which pitted Trump against former Secretary of State Hillary Clinton, who had campaigned against high prescription drug prices, the healthcare sector fell 6.6% in October compared to a 1.9% drop for the overall S&P 500 . So far this October, the sector has climbed 1.2% against a 1.7% rise for the S&P 500. The promise of a fiscal stimulus package has lifted groups such as financials and industrials that tend to be more sensitive to broad economic recovery. Edward Jones' Evans sees opportunities in shares of drugmaker Merck & Co and medical device company Medtronic Inc. Merck shares have fallen 12% so far in 2020, while Medtronic shares have dropped about 7%. Melissa Chadwick-Dunn, portfolio manager at RS Investments, has long-term holdings in areas such as diabetes technology and biotech, where she sees strong potential for healthcare breakthroughs, and potentially would add if there is a pullback. "The best antidote to all this uncertainty is a healthy dose of innovation," she said. (Reporting by Lewis Krauskopf; Editing by Ira Iosebashvili and Bill Berkrot) Here is my web-site: pgjoker

This overview on DIY family pet grooming is fantastic! It's saving me a lot cash 24 hour dog daycare near me

This write-up made me rethink my grooming routine for my pet dogs cheap dog daycare

I am not certain the place you're getting your info, but good topic. I needs to spend some time learning more or working out more. Thanks for magnificent information I was looking for this info for my mission. My website - Clicking Here

My friends and I used truck rental santa cruz for our camping trip, and the truck was perfect! Spacious and reliable

10 Strategies Overcoming Loneliness 오피사이트

I appreciate the information on different roofing types! It's helpful to know what options are available. If you're looking for more details, visit Amstill Roofing Roofing Company in Houston for comprehensive guides

Night Spa 하이오피주소

Blackberry Curve 8520 - Budget Phone With Decent Blackberry Features 다바오환전