Share This

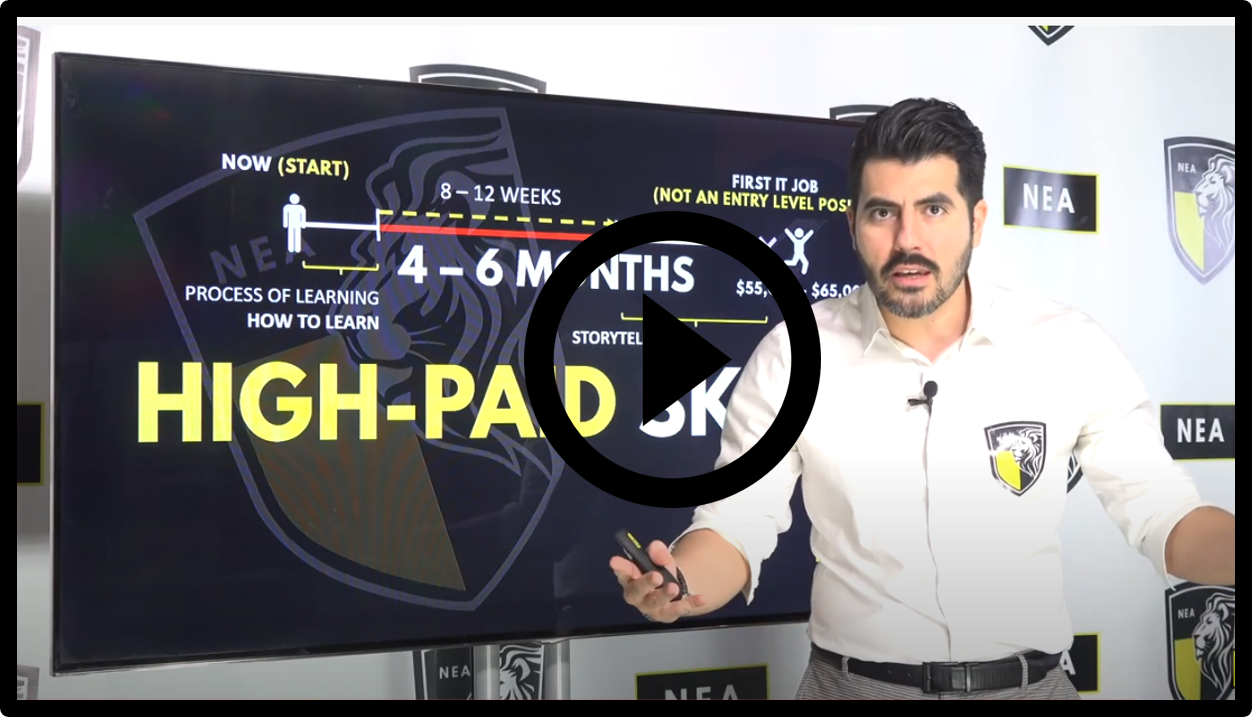

Reverse Engineer the Process. This is the most effective way to get ANYTHING YOU WANT in life, but ONLY if you're willing to do the work.

Let's be honest here...

How bad do you want to have a high paying career in IT, opportunities for you to grow, more joy, happiness, and fulfillment in your life?

You can spend a whole damn day writing a list of everything you want.

But what about the list of things that need to happen for you to ACTUALLY achieve them?

See,

There are powerful and strategic routines you need to have in place that are designed to get you the end result you want...

KNOW WHAT TO DO AND HOW TO DO IT MATTERS - A LOT!

In this video I will show you the strategies and routines.

Also, there are things you need to do about how to approach, who you need to become, what to do, how to do it, and the high-paid skills you need to learn to get all the way to a high paying IT job.

In this video I'll help you have clarity and certainty around those things you have to do and focus on in the next few months, this will allow you to move fast and execute on them.

There’s hard work that needs to get done and targets (goals) that need to be hit...

I'll show you how to reverse engineer your targets and help you amplify your productivity to achieve each one of them in the next few months for you to get the job you want.

I am really excited about sharing the detailed plan with you.

And yes! It works, students have gotten a better higher paying job in their IT Career by following this same process/plan.

The question here is...

ARE YOU WILLING TO PUT IN THE WORK TO GET IT?

Casino Characters And Many A Free Bet 라이트닝 에볼루션

Wholesome Roulette Betting System Proven Function 드래곤볼 에볼루션

Fascinating read about the different learning styles children exhibit even at such a young age—daycare can cater to all types! preschool

Amazing service remodeling companies in houston

Karaoke Bar 하이오피주소

I learned so much about my PS5’s inner workings thanks to the articles on PS5 Repair Dumont NJ

I enjoyed this post. For additional info, visit استخدام نیروی نمایشگاهی

Given all the talk around Arm Holdings' blockbuster debut on the Nasdaq, you may be surprised to hear that London's junior market is home to another, albeit significantly smaller, fabless chipmaker in Sondrel (Holdings) plc. Sondrel is in the business of application-specific integrated circuit (ASIC) designs, which is geek speak for computers that are designed with just one job in mind. Bitcoin miners, for instance, use an ASIC built to mine bitcoin and nothing else. You get the point. London's junior market is home to another, albeit significantly smaller, fabless chipmaker in Sondrel (Holdings) plc. Anyway, while Arm Holdings takes flight in New York, adding 20 per cent on the first day of trading, Sondrel has had a bit of a shocker. Shares were down another 15% this week as it continued to reel from project delays and scaled back customer orders. Year to date, Sondrel is down a crushing 76 per cent. In its latest earnings call, the group conceded that full-year revenues will be 'substantially below current market expectations', with a corresponding impact on full-year losses. This Wednesday, Joe Lopez agreed to step down as chief financial officer with immediate effect, with non-board interim CFO Nick Stone taking the temporary mantle. A coincidence of timing perhaps? As for the wider small-cap market, the AIM All-Share Index got off to a worrying start after losing nearly 1 per cent on Monday. This was despite the blue-chip index starting the week on the front foot in anticipation of a packed week of macroeconomic news. Thankfully, junior stocks swung in the right direction as UK unemployment met expectations, as did the European Central Bank's 25 basis point interest rate decision. US inflation figures were a little on the heavy side, though not enough to spook the markets. The AIM All-Share ended up recovering those Monday losses to close the week flat at 746.42, though this was a marked underperformance against the FTSE 100, which gained over 3 per cent. A large chunk of the value of shares in disposable vape distributor Supreme were thrown in the bin following damning research into the environmental effects of cheap, single-use vaping kits. Shares were down 16.6 per cent across the week. Ocean Harvest Technology Group plc, one of AIM's very few debutants in 2023, took a light battering in the wake of its first interim earnings report as a publicly listed company. The group, which specialises in researching, developing and selling seaweed products for use in the animal feed industry, reported a delay in onboarding new customers in Europe due to surging feed ingredient prices, sending shares down 18 per cent. RELATED ARTICLES Previous 1 Next SMALL CAP IDEA: Which London-listed cybersecurity firms... SMALL CAP MOVERS: Will Ergomed and Instem end up on the... CMA backs aviation watchdog over Heathrow charges row ALEX BRUMMER: Our flawed Saudi friends are helping to fuel... Share this article Share Shareholders made their thoughts clear on medical technology company Belluscura's interim results, with shares diving over 18 per cent this week. Revenues and earnings figures objectively justified this response, with top-line sales falling a third year on year to $400,000 (£321,000) and adjusted EBITDA falling 30 per cent to $2.9 million. It's never a weekly roundup without discussing the latest delisting news. This week it is brought to you by Sportech. You may be aware of Sportech through its pool-betting site 123Bet, or perhaps Connecticut, US readers have visited one of its nine licensed gaming entertainment venues in the state. Monday's solid set of results - which showcased a threefold increase in underlying earnings - weren't enough to dissuade the group from ploughing ahead with its plan to delist from London's junior AIM market. 'Despite delivering improving operational results announced today, the substantial financial cost associated with maintaining a public listing, given our current scale, and the increasing volatility in the market valuation is adversely impacting net returns and future prospects,' said executive chairman Richard McGuire. Hardly an uncommon sentiment in the 2023 capital markets. The heavy industries proved AIM's saviour this week, thanks to a revival in sentiment for China-exposed industries and surging commodity prices. Exploration and development minnow Critical Mineral Resources (formerly Caerus Mineral Resources) had a bumper week, leaping close to 50 per cent after confirming the completion of its Cyprus asset sale. Other top industrial movers saw Synergia Energy, Pantheon Resources and Cadence Minerals plc all up over 20 per cent, with Atome Energy and Coro Energy surging in the high teens. LoopUp Group led the charge in the communications sector after smashing revenue and margin targets in its interim earnings. Shares were seen around 40 per cent higher week on week. Lastly, Keystone Law plc turned heads on Thursday after it confirmed full-year results will be 'comfortably ahead of market expectations'. Shares closed the week a little over 10 per cent higher as a result. To read more small-cap news click here website DIY INVESTING PLATFORMS Easy investing Stocks & shares Isa £1.50 fund dealing 0.25% fee on fund holdings Investment ideas Free fund dealing Free fund dealing 0.45% account fee capped for shares Flat-fee investing No fees From £4.99 a month Trade shares and funds for £3.99 Social investing Social investing Share investing 30+ million global community No account fee Investment account Free share dealing Free fractional share* Affiliate links: If you take out a product This is Money may earn a commission. This does not affect our editorial independence. *T&Cs apply. > Compare the best investing platform for you

Wine Tasting Op

Wine Tasting HiOP

Luxury Lounge 오피

Please let me know if you're looking for a writer for your weblog. You have some really good posts and I feel I would be a good asset. If you ever want to take some of the load off, I'd absolutely love to write some articles for your blog in exchange for a link back to mine. Please blast me an email if interested. Cheers! Also visit my homepage ... Clicking Here

Purchasing Chairs For Your Personal Home 광주유흥 - Kari -

Clubbing 오피 (https://psihoman.ru/)

Night Club 오피커뮤니티

Night Out 밤문화

How Choose Women Up At A Golf Iron - Start Using 3 Killer Methods 유흥 (Franziska)

Guide To Thai Islands hiop

Beating Company Blues Home Jobs 오피 - Https://easyaccounting.Lk -

3 Popular Ways To Personalise Promotional Oyster Card Holders 다바오 포커 가입 (hwang-maurer-2.blogbright.net)